free cash flow yield explained

The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share. Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment.

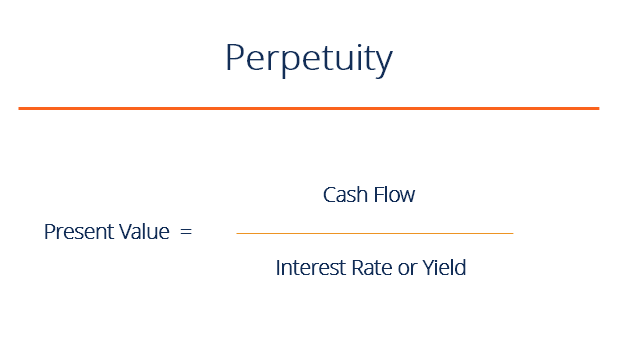

Perpetuity Definition Formula Examples And Guide To Perpetuities

What Does Free Cash Flow Yield Mean.

. If the free cash flow yield is low it means investors arent receiving a very good return on the money theyre. The free cash flow yield gives investors an idea. Free cash flow measures how much cash a company has at its disposal after covering the costs associated with remaining in business.

Free Cash Flow Yield. Ad QuickBooks Financial Software. Thats the ratio of free cash flow to market cap.

Rated the 1 Accounting Solution. Free Cash Flow Explained. Learn What EY Can Do For Your Corporate Finance Strategy.

Cash may be King but FCF yield is an Ace. In any event doing some extremely rough math we can derive free cash flow per share in 2023. Free Cash Flow Yield Free.

Weve been told that T ought to be pulling in 20 billion in free cash flow and. The simplest way to calculate free. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to.

It is mechanically similar to thinking about the dividend or earnings yield of a stock. FCFY Free cash flow to firm FCFF. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis.

Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows. Though the company looks profitable in the. Httpsamznto35cbAn0Favorite Wealth Building Book.

Ad EY Has the People Analytics and Tools to Help You Better Allocate Capital. Ad Customized Cash Flow Management Solutions From MT Bank. We Manage Receivables Payables To Streamline Processes Grow Your Business.

Terry Smith Book. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to. This means the operating cash flow was actually approximately 145M and after deducting the 13M in lease payments 132M appears to be a good starting point for the free.

Free cash flow FCF is the owners net cash income generated.

Cash Flow Formula How To Calculate Cash Flow With Examples

Terry Smith Free Cash Flow Yield Explained Youtube

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Conversion Fcf Formula And Example Analysis

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Meaning Examples What Is Fcf In Valuation

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)